We specialise in serving headquarters of global brands, helping them cut complexity costs in strategy execution across markets and fulfil their corporate role as scale economisers and advantage accelerators. Leverage our consulting expertise, technology solutions and remote talent resources to create organisational simplicity, scalability and efficiency in multi-market operations.

Transforming global brand marketing, creative and eCommerce capabilities into a competitive advantage

(EMEA) 47 markets

(EMEA) 47 markets

(EMEA) 14 markets

(EMEA) 14 markets

(EMEA) 17 markets

(EMEA) 17 markets

(WHQ)

(WHQ)

Seismic Shift in CPG E-Commerce Growth

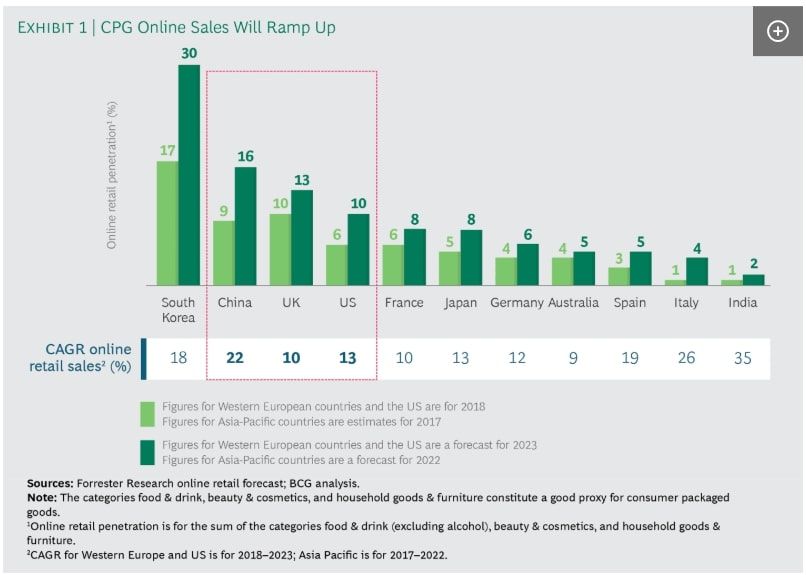

A seismic shift is occurring in consumer packaged goods (CPG)—but manufacturers are not keeping pace. Online sales grew rapidly from 2013 to 2018—19% annually versus the anaemic 1% growth rate of in-store sales. All told, e-commerce now accounts for 40% of the growth in CPG retail sales. The problem: large CPG companies continue to lag in e-commerce, posting weaker performance in the online arena than they do in the offline.

E-commerce now accounts for 40% of the growth in CPG retail sales, while large CPG companies continue to lag in e-commerce

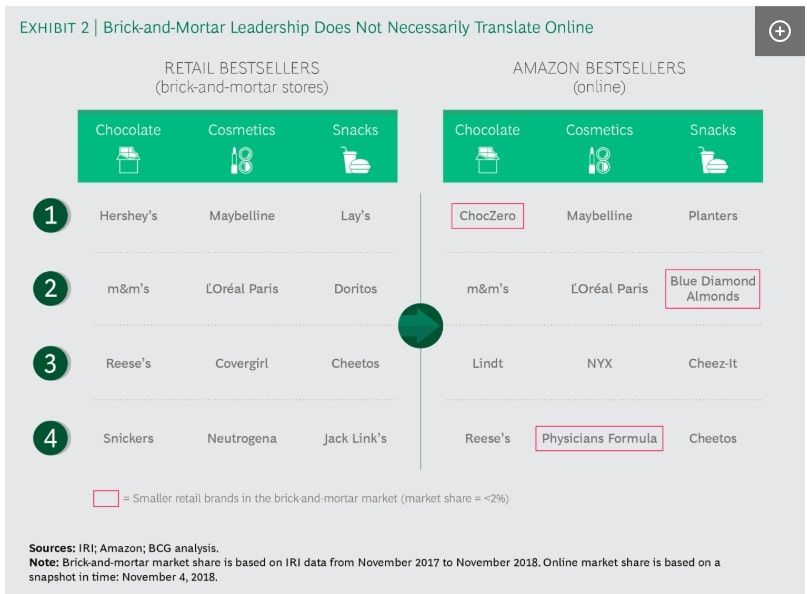

This lagging performance comes at an increasing cost. Large CPG companies, on average, have online market shares that are at least 5 to 10 percentage points below the shares they enjoy in the brick-and-mortar world. This translates into hundreds of millions of dollars in lost sales opportunities. In addition, CPG companies (and retailers) have struggled to develop online categories in which a high percentage of sales are impulse or unplanned purchases—including confectionery, where almost half of sales are unplanned. CPG companies have generally been slow to devote significant resources to e-commerce for several reasons. Among them: online sales have not taken off as quickly in CPG as they have in other categories, such as books and consumer electronics. According to Nielsen, the online channel accounts for less than 10% of overall CPG sales; the penetration varies by product category. Some 13% of revenues in the pet care category, for example, comes from online sources, while the share from meat and dairy is just about 2%. Given the relatively slow takeoff in most categories, companies have simply not been forced to adapt as quickly in the CPG space as they have in some other sectors. Around the world, however, the share of sales coming from online channels is expanding rapidly. But, brick-and-mortar category leadership does not necessarily translate online.

BCG.com & Forrester research

Big CPG companies can reverse their slow start in e-commerce. One of first and main things is to match the strategy to the e-commerce retail environment and meet the demands of different e-retail environments.

Match the strategy to the e-commerce retail environment and meet the demands of different e-retail environments.

Today, many companies’ e-commerce strategies focus on selling products through Amazon. No doubt, Amazon remains the leader, accounting for an impressive 44% of all US e-commerce sales in 2017 (about 4% of total retail sales) according to Edge by Ascential. But there are many other e-commerce retail sites—including those with so-called click-and-collect models, where consumers purchase goods online and then pick them up in the store—on which CPG companies must also capture share to maximize total growth.

While many companies focus on selling through Amazon, there are other e-commerce retail sites where CPG companies must capture share to maximize total growth

The explosive growth of e-commerce is transforming the retail world—and changing the sources of competitive advantage for CPG companies. To survive and thrive, CPG players need to embrace the disruption. They must develop strategies that are tailored to the myriad of online retail environments in which they will compete and the models they will face.

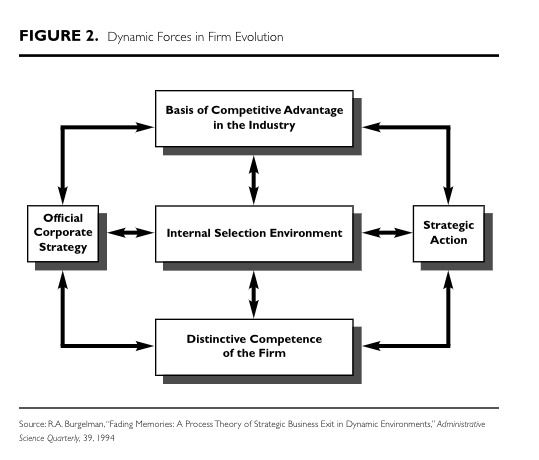

Strategy as a Continuous Bet Making & Updating

The reality is that strategy is about making choices under competition and uncertainty. No choice made today can make future uncertainty go away. The best that great strategy can do is shorten the odds of success. Strategy means making the best possible choices you can make today and then being responsive when the bets do or do not come in as hoped. In essence, the strategist says “this is what I think will happen,” watches what does happen, and then updates the strategy and bets based on the newest information. In face of uncertainty established companies also use 'strategic options ' - small-enough bets that a company can walk away from them. Even though they do incur monetary costs, which in the short term may be high, in the long run they save money and provide strategic choice flexibility.

Strategy means making the best possible choices you can make today and then being responsive when the bets do or do not come in as hoped.

So rather than seeing strategy as a way to get rid of uncertainty, strategy is more a way of dealing productively with life’s inevitable uncertainty, by continuously making and updating your bets about the future.

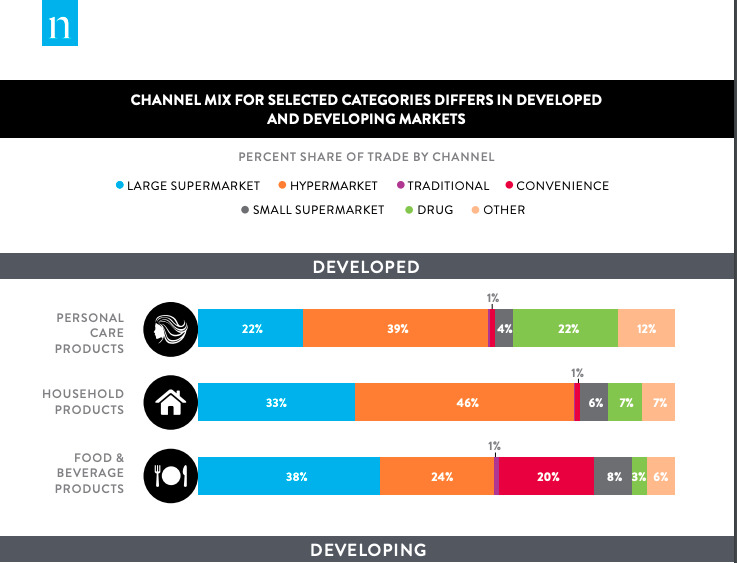

In developed markets, traditional retail sales are concentrated in large supermarkets and hypermarkets, accounting for 61% of personal care, 62% of food and beverage and 79% of household care category sales. In the food and beverage category, convenience stores are also a sizable player, accounting for 20% of sales. Similarly, in personal care, 22% of sales come from drug stores.

Nielsen Global E-Commerce and The New Retail Report

Large supermarkets and hypermarkets are important players in the global retail landscape and this will continue well into the future. However, with a few exceptions (such as in the United Kingdom, where Tesco and pure-play retailer Ocado have made assertive moves), Europe’s online-grocery market has been stuck in a vicious cycle: poor supply drives low demand, which in turn justifies the poor supply. The online-grocery market is poised for growth. But only early movers will win—and only if they are adept, disciplined, and agile

Large supermarkets and hypermarkets are important players in the global retail landscape and this will continue well into the future.

McKinesy's report on global customer and channel management identifies that in markets where modern retailers dominate and e-commerce is growing rapidly—markets such as Europe and North America—leading CPG players focus on power partnerships and omni-channel management. There, winning companies have invested heavily in data, tools, and capability building to keep their insights and knowledge on par with retailers and to retain their competitive edge during negotiations. This enables them to transform transactional relationships into true power partnerships; they can enter into mutually beneficial data-sharing agreements with retailers and are better equipped to address longer-term strategic issues. Winners develop market-specific strategies, while ensuring strong buy-in from their leadership teams on key strategic decisions. One such decision is how—and how deeply—to partner with Amazon and other pure-play e-commerce companies; another is how to do business with multichannel players. Winning companies regularly review and adjust their route-to-market models (for example, direct store delivery or third-party distribution) and adjust their resource allocations depending on expected channel growth and cost-to-serve drivers.

Leading CPG players focus on power partnerships and omni-channel management

However, even with these useful guidelines, fact remains that professionals in CPG companies which are tasked with e-commerce channel and account growth still have a very limited insight to make strategic growth bets. Within a highly dynamic and competitive e-retail environment best bet is Amazon, however, dependency on a single growth partner can be very dangerous and even short-lived.

As we saw just last week, even Amazon, as it pulls out of China (which admittingly is a very unique market), isn't panacea for every market and category. Partnerships with Amazon aren't always ideal either. "We are learning the hard way that Amazon will lock you in with the growth and then start squeezing you on profitability of each SKU" are just some of the stories of companies which lured by growth, pressured by time and lack of viable alternatives, ventured too easily and too quickly.

"We are learning the hard way that Amazon will lock you in with the growth and then start squeezing you on profitability of each SKU"

So it is clear that CPG professionals need to leverage different channel partners and business models to get most of the e-commerce growth. But which ones do you focus on? With limited information availability, in a very dynamic and unpredictable industry, making CPG e-commerce growth bets is like making chess moves in a fog.

CPG E-Commerce Channel & Account Development and Strategic Growth Bets

To meet their collective and category growth and profitability targets, CPG professionals need to meticulously plan, negotiate and execute partnerships with channel partners and account clients to find and leverage pockets of growth. As most CPG companies do not have own D2C capabilities, this means their growth targets, in mature markets and categories, depend on e-commerce and omni-channel growth capabilities of their channel partners. Given very limited ability to influence partners' scope, size or speed of e-commerce capabilities development growth, to achieve their directly dependant e-commerce category growth targets CPG professionals need to place different strategic bets with different partners. With portfolio of channel partners' e-commerce growth bets CPG professionals can aim for multiple scenarios will materialize in way that will enable them to meet their goals. However, with pace and complexity of market developments, compounded with limited partner informational alignment and data sharing, preciseness is impossible. But strategic bet placement accuracy can be improved.

To achieve their directly dependant e-commerce category growth targets CPG professionals need to place different strategic bets with different partners

To be able extend the horizon deeper into the fog of uncertainty that covers CPG e-commerce development outlook, while taking into account the category insights, traditional retail partnerships, as well as today' opportunities within Amazon, one needs to take and keep a closer look at underlying structural sources of CPG e-commerce growth and underlying motives of participants.

Looking at CPG e-commerce market players competition through the lens of time based competitive strategy, we can isolate the basis of competition to identify current and future source of growth

- Time Based Competitive Strategy & CPG E-Commerce

The element of time management as a competitive strategy has become the focus of many research studies. One such study was done in January 2016 by Alicia Neva Weber-Snyman and Johanna A. Badenhorst-Weiss from University of South Africa, which researched time-based competition as a competitive strategy for online grocery retailers. Some of the key findings of the study were :

- online grocery shopping is perceived as a time-saving activity which motivates consumers to participate in this service

- from retailers perspective its perceived as time-consuming to offer this service and as such time is a barrier

- consumers need to plan ahead for online grocery shopping if they wish to receive full value of the service offering.

- opposing market forces of economic pressure (characterised by cost consciousness), on the one hand, and higher customer expectations (a need for faster delivery coupled with possible cost implications

- the strategy looks promising as some online retailers have already started to utilise time as a competitive advantage. Amazon.com for example charges different rates for different delivery times

This study (and many others in this field) gives a strategically useful perspective on how to view / look at the CPG e-commerce market development and e-commerce players competition and use it to come up with scenarios of possible growth developments. Looking at CPG e-commerce market players competition through the lens of time based competitive strategy, we can isolate the basis of competition to identify current and future source of growth. According to this, those CPG e-commerce players who perform better along the line of time competition - faster and more convenient deliveries to customers are those who are poised for growth.

CPG e-commerce players who perform better along the line of time competition - faster and more convenient deliveries to customers are those who are poised for growth.

So within this perspective, as customers' main incentive to participate in online grocery shopping is time saving and convenience, the underlying driver of CPG e-commerce growth is time-to-consumer - faster and more convenient deliveries to end customers, With this in mind, by looking closely to post-purchase performance of e-commerce channel partners and CPG clients, holding all other elements equal (category, assortment fit), CPG professionals can place strategic bets for e-commerce growth with those partners that structurally perform better in dimension of delivery or time-to-consumer.

CPG professionals can place strategic bets for e-commerce growth with those partners that structurally perform better in dimension of delivery or time-to-consumer.

Helping CPG Professionals Optimize Strategic E-Commerce Growth Bets

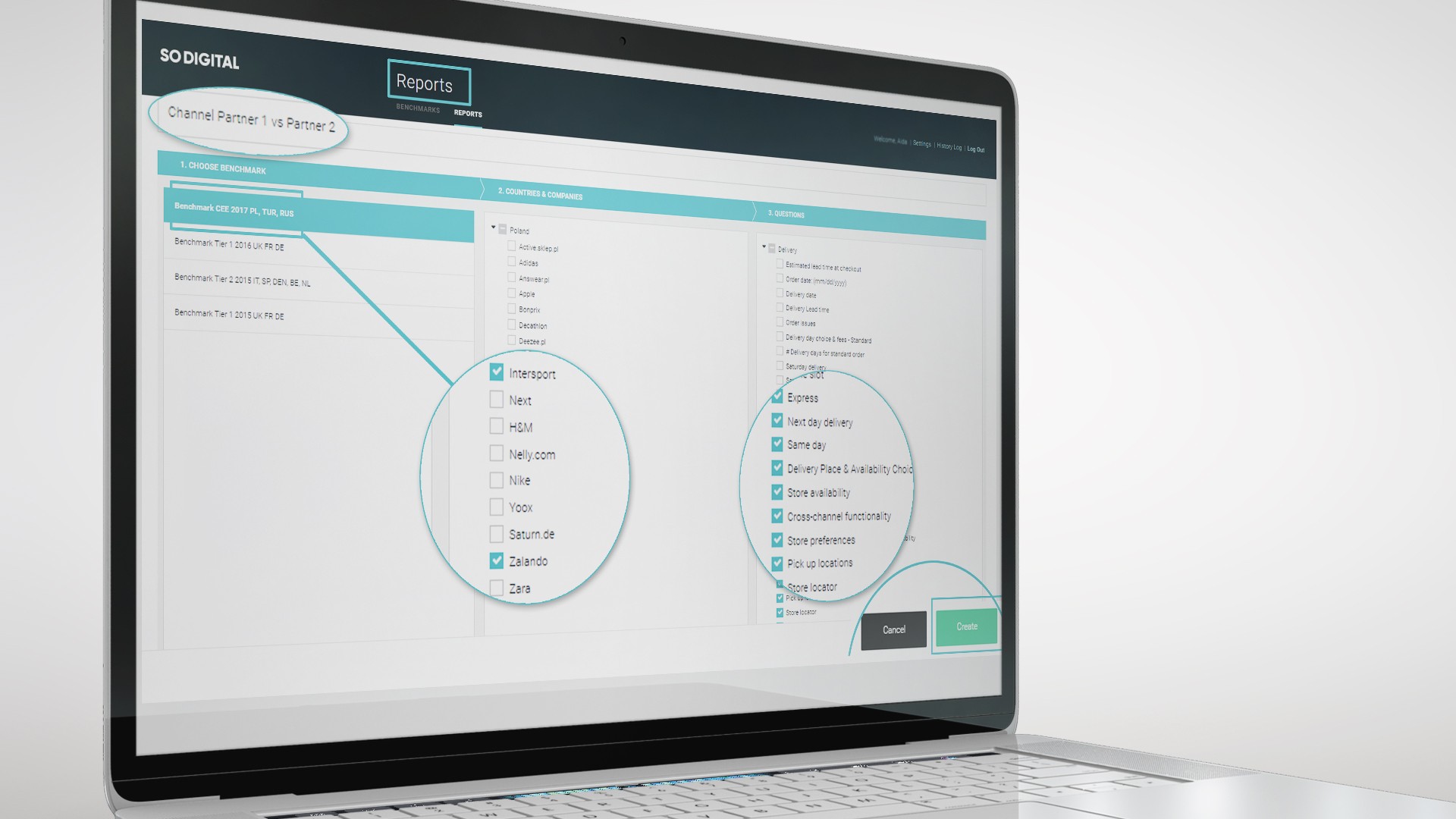

SO DIGITAL GLOBAL E-COMMERCE BRAND EXCELLENCE PLATFORM is a management tool that helps CPG companies formulate, evaluate, and improve their e-commerce strategic growth bets by providing a systematic assessment of competitive performance of post-purchase and delivery performance of channel partners across markets. Trained researches in target countries perform actual purchase of products from target e-retailers, recording their every step, while answering standardised scale based scorecard with average 200 data points to provide insight into comparative performance of their channel partners, competitors and leading e-retailers on selected dimensions.

By leveraging insights of e-commerce deliveries development and broader post-purchase experience CPG professionals can place more accurate strategic growth bets with those e-commerce and channel partners that structurally perform better in dimension of delivery or time-to-consumer.

Express delivery not available at Intersport, while at Zalando it is available with Paid option

Leveraging insights from our platform CPG professionals can improve their negotiation position in relationship building with individual CPG e-commerce retailers, as well as make more informed decisions on marketing investments distribution across diverse channel partners.

Furthermore, by leveraging competitive insights from our platform into both leading CPG e-retailers as well as competitors, CPG professionals are able to guide and optimize their decisions on cost / profit elements such as packaging and pack sizes. These insights can have an immediate and structural effect on profitability. For instance, larger pack sizes can encourage stock-up behavior and also help push the transaction up to $10 to $15—the point at which the shipping economics often improve for any given individual item. CPG players can also design specific online pack sizes and prices to avoid problematic, visible price differentials among channels.

To start driving your eCommerce growth by focusing on post-purchase experience of your channel partners and account clients as well as competitors and leading CPG e-commerce players contact us today for a free no-commitment one-on-one walk through of the solution & service and use client case of Nike (EMEA).

Current Market Development Proofs of TBC View

1. Curb-side pickup growth as a result of previously observed opposing market forces.

Born out of 2016 study observed opposing market forces of economic pressure (characterised by cost consciousness), on the one hand, and higher customer expectations (a need for faster delivery coupled with possible cost implications, 2018 curbside or click-and-collect exploded. As it represents a "half-way" solution for both retailers and consumers in terms of time saving and cost curbside pickup saw massive rollout in 2018. By the end of the year, curbside pickup was available in 45% of Walmart stores, 58% of Kroger stores, 56% of Target stores (notably up from 0.6% at the beginning of the year), 30% of Ahold Delhaize stores, and 21.7% of Albertsons stores. And there’s no sign of curbside pickup slowing down any time soon. Walmart recently announced plans to have 2,140 online grocery pickup sites by the end of 2019, covering 69% of U.S. households, and for fiscal 2020, it’s targeting 3,100 curbside pickup sites.

2. Rise of Disruptive Start-Ups in Last-Mile Delivery

Instacart, Deliv and Postmates are just some of many startups that have been exploding and recording revenue growth by fixing the obvious market problem of consumers wanting faster and more convenient deliveries and emerging CPG e-retailers not being able to provide them profitably. The Postmates delivery fee is $1.99 to $3.99 for partner merchants or a delivery fee in the range of $5.99-$9.99 for other merchants. In addition, a variable percentage service fee of c. 9% is applied to the customer’s order value. Instacart is a crowdsourced on-demand grocery delivery service in the US. Personal shoppers fulfil online orders at local stores and deliver to the customer’s home usually within one or two hours after receiving the order. Grocery retail partners include Whole Foods Market, Costco, Kroger and Target. Instacart adds a 15%+ mark-up on the grocery order price in addition to a delivery fee that varies depending on the selected delivery window. However, customers can avail of free delivery if they register for an annual membership with Instacart Express. Membership starts at $99 for the first year before increasing to $149 per annum thereafter.

3. CPG E-Commerce Leaders are Betting on Time

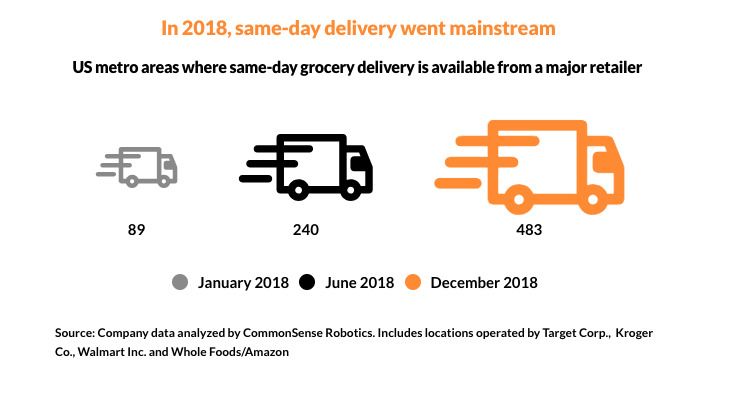

According to Deutsche Bank, of 23 major retailers, only two are making same-day (or faster) delivery their primary focus : Target, who acquired Shipt at the end of 2017 and now serves 200 metro markets with same-day delivery, and Amazon, who expanded Prime Now grocery delivery from Whole Foods in 63 cities across the U.S. by the end of 2018. In 2018 Target reported an impressive 49 percent year-over-year digital-sales growth, largely the result of investments in digital, delivery and store-pickup capabilities to enable the e-commerce operation. Target's record e-commerce sales growth continues in 2019 as well. Wallmart.

Also at the end of 2018, major retailers offered same-day grocery delivery in 483 U.S. metro areas, up more than 500% compared with the beginning of the year. Those figures represent Target, Kroger Co., Walmart and Whole Foods/Amazon.

4. Customer Expectations Around Delivery Times Will Only Increase

Both Accenture and KPMG report that customer expectations around delivery and other aspects of omni-channel fulfillments will only increase, a so retailers that thrive in the emerging environment will be those that start adapting sooner. The growing need for a seamless, more immediate delivery experience is influenced by a marketing paradigm shift that Fjord, the global design and innovation consultancy, terms “liquid expectations”. Customer expectations are no longer limited to a given product category: instead, they extend across unrelated industries and experiences. For instance, customers increasingly compare the slick user experience offered by digital natives such as Uber, Deliveroo and Amazon with their airline flight cancellation, their visit to the doctor or their recent product return.

-------------------------------------------------------------------------------------------------------------

References :

Roger L. Martin: HBR.org : "Placing Strategic Bets in the Face of Uncertainty" https://hbr.org/2013/01/placing-strategic-bets-in-the

George Stalk, Jr. Ashish Iyer, HBR.org : "How to Hedge Your Strategic Bets" https://hbr.org/2016/05/how-to-hedge-your-strategic-bets

Taylor Smith , Kaelin Goulet , and Sonya Hoo: "How CPG Companies Can Catch Up as Online Sales Take Off" https://www.bcg.com/publications/2019/consumer-packaged-goods-online-sales.aspx

Kari Alldredge, Julie Lowrie, and René Schmutzler: McKinsey & Company : "Global customer and channel management: What the best CPG companies do" https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/global-customer-and-channel-management-what-the-best-cpg-companies-do

Nicolò Galante, Enrique García López, and Sarah Monroe, McKinsey & Company : "The future of online grocery in Europe" https://www.mckinsey.com/~/media/McKinsey/Industries/Retail/Our%20Insights/The%20future%20of%20online%20grocery%20in%20Europe/The_future_of_online_grocery.ashx

Weber-Snyman, Alicia & Badenhorst-Weiss, Johanna. (2016). Time-based competition as a competitive strategy for online grocery retailers. Journal of Contemporary Management. 13. 2016-433.

Robert A. Burgelman, Free Press, New York, 2002 "Strategy is Destiny: How Strategy-making Shapes a Company’s Future"

Suman Bhattacharyya , DigiDay UK : ‘Cost of doing business’: Target’s e-commerce sales growth means higher logistics costs

Accenture : "How could last mile delivery evolve to sustainably meet customer expectations" https://www.accenture.com/_acnmedia/PDF-95/Accenture-Last-Mile-Delivery-Meet-Customer-Expectations.pdf

"More grocery purchases will move online in 2019 " Internet Retailer .& KPMG's 2018 Grocery Retail Consumer Perception Survey.